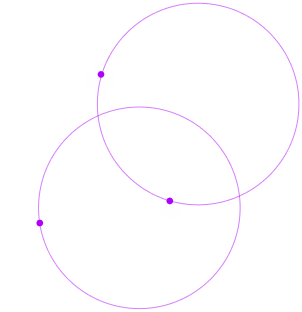

Employer of Record (EOR)

Expand your business in India without the hassle of setting up an entity.

An EOR (Employer of Record) helps you hire, onboard, pay, insure, and support your hardworking team in India without establishing an entity. In this model, we can assist you in hiring the best talent with accurate background checks, manage payroll, compliance, benefits and equities, the office desk, and asset procurement under one umbrella, and help administer employment-related responsibilities for you.

We also handle immigration, visas, relocations, and freelancer & contractor-to-employee conversions, making it simple for businesses to hire distributed talent in India.

OBOX saves you time, energy and resources and helps you hire the right employee.

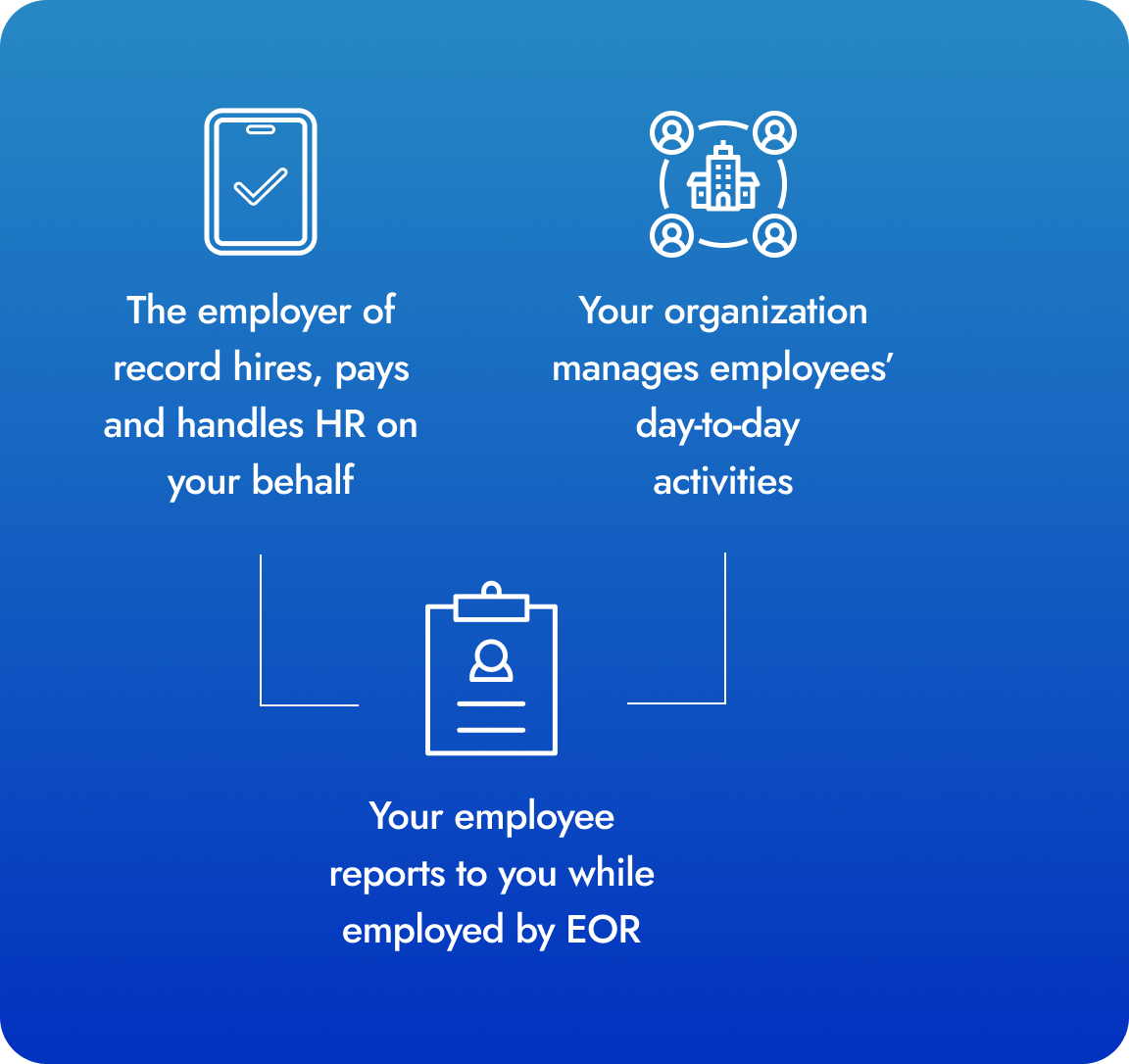

| Entity Setup | EOR | |

|---|---|---|

| Setup & Operations | Upto 12 months | Few Days |

| Onsite requirements | Signatories on bank accounts and corporate documents must often sign in person | Included |

| Banking | Rigorous KYC regulations | Not required |

| Compliance | Average companies spend 1 day per week simply tracking regulatory changes | Will be taken care by OBOX |

| Talent | Can lose candidates while waiting for subsidiary, contractor liabilities, lower talent pool | Ready to hire as soon as you finalize candidate, access to larger talent pool, no contractor liabilities |

| Local directors | Foreign subsidiary often requires a local director – there are legal liabilities | Not required |

| benefits | Statutory and customary | Will be taken care by OBOX |

| Employment contracts | Foreign offer letters are not valid employment contract, need country-specific contracts and legal expertise | Will be taken care by OBOX |